|| Introduction for DCC ICO

DistributedCredit Chain (DC) represents the world's first decentralized system, which seeks with the help of technology, the Blockchain, to organize all participants in financial services.

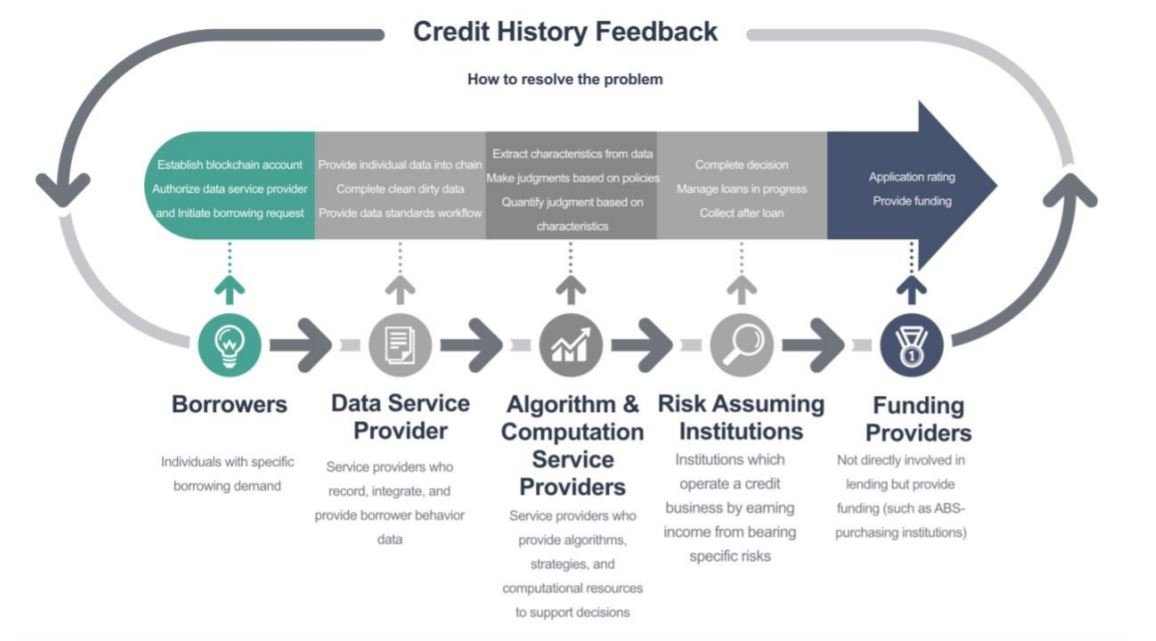

The main goal of the project is to improve all available financial scenarios, due to which:

any borrower will be able to log in to the blockchain system without any problems for interaction with suppliers, as well as data transfer;

it will be possible to extract different characteristics of the data, as well as to clean them, avoiding the biggest problems in the future;

the platform will eliminate such problems of the centralized system as long-term borrowings, and will also allow them to be settled, at the expense of a transparent blockchain system;

any funding provider will be able to earn with DCC easily and conveniently, as well as manage their business safely and securely.

|| Project Advantages

The whole essence of the project is to build a new system that seeks to bring into the world of financial lending, clean and transparent relationship between the borrower and the supplier. Therefore, the DCC intends to decisively change the entire existing monopoly structure of the traditional market of financial institutions, so that in the future each participant in this sector can earn their rightful income within the framework of the environmental growth of the system.

The use of Blockchain technology will allow DCC to change the usual course of operations in banking systems, which will lead to a permanent increase in communication not only between different regions of individual parts of the state, but also around the world. This approach will allow to transform the entire existing structure, setting new standards, increasing the overall level of business worldwide.

As for government regulations, due to its transparent structure, the Blockchain provides open access to data, which as you already know is not subject to any change, at the expense of smart contracts. Thanks to this organization requesting the test data easily and quickly be able to understand and help with different resolution of data, and to prevent any risks.

I decided to write and express some of my opinions in my blog space, Here. According to my opinion banks are the most impolite Financial Institution I have dealt with. Everyone loves the outfit and showoffs of banks until they borrowed a loan.

I remember the day, which I create my credit card from a famous local bank. More than 2 hours of my precious working time was wasted due to the outdated dragging procedures in the KYC process and in other transaction processes. But this much of heavily technological developed era, It was just bad and impolite for any customer. In the other way, credit levels offering from the bank is so limited for most of the bank users. It will take years of time to increase this credit levels to a certain level, but I can clearly say that level will not even be doubled from the initial value.

Just as I do, I think many people have very bad expressions about current traditional financial institutions and their outdated systematic procedures. If you are or not you can clearly identify Distributed Credit Chain (DCC) as the savior of the humiliated clients of the existing crediting system.

Foundation of the DCC is a distributed public blockchain. Unique qualities of blockchain technology like seamless coverage, trustless transactions, efficient performances will enhance the disrupt create by the DCC.

DCC will change the crediting systems from highly centralized state to a decentralized status, this will deactivate the monopoly owns by them over the clients. Due to the ability to have numerous debtors in a decentralized system, borrowers will be able to choose a debtor on their demand. Rates of the debts and borrowings will rigidly not affected by third-party interactions.

DCC owns a Distributed Credit Data Management Framework. Simply DCC adopt a Distributed Identity Verification process, where their own personal data will be handled by themselves. Peer-to-peer verification facility is enabled on the DCC with individual to individual or individual to institutions. so they can deal with their data and credits without any intermediate trusted party. That will reduce the costs like banking fees, verification charges etc. In another way, this system can be an effective source of credit data in any kind of business scenario.

|| ICO Conclusion

The entire Distributed Credit Chain system has huge potential. This model can be applied in any part of the financial industry. A team of specialists worked on the project, who clearly see their goals and know in which direction they should develop. Therefore, I recommend you to study the concept of this project in more detail, as well as to take an active part in it. Since we are closely connected every day in various financial organizations and do not understand how sometimes they use us, while achieving their own goals. I think this needs to be changed, stop being their puppets, it's time to put an end to it. In addition, now there is a great alternative to traditional systems - the distributed Credit Chain platform.

Official sources of DCC ICO,

WEBSITE: http://dcc.finance

TELEGRAM: https://t.me/DccOfficial

WHITEPAPER: http://dcc.finance/file/DCCwhitepaper.pdf

FACEBOOK: https://www.facebook.com/DccOfficial2018/

MEDIUM: https://medium.com/@dcc.finance2018

TWITTER: https://twitter.com/DccOfficial2018/

ANN THREAD: https://bitcointalk.org/index.php?topic=3209215.0

TELEGRAM: https://t.me/DccOfficial

WHITEPAPER: http://dcc.finance/file/DCCwhitepaper.pdf

FACEBOOK: https://www.facebook.com/DccOfficial2018/

MEDIUM: https://medium.com/@dcc.finance2018

TWITTER: https://twitter.com/DccOfficial2018/

ANN THREAD: https://bitcointalk.org/index.php?topic=3209215.0

Prepared by ;

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1547972;sa=summary

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1547972;sa=summary

No comments:

Post a Comment