Investment is a huge aspect of any person's financial activities. Investments provides a sense of security and assurance to a person because of its potential to provide great returns and profits. Some standard investment methods which we are familiar with include bonds, stocks and cash. These methods are quite straightforward, affordable and popular among people of all financial classes, especially the middle class. But there is another less prominent category of investments, called Alternative Investments.

As the name suggests, alternative investments are a class of investments that are different from the mainstream investment options. They include private equity, hedge funds and managed futures, real estate, commodities and derivatives contracts. You might be unfamiliar with most of these terms, or have very little idea about them, because they are not the conventional investments that most people undertake. The fact is that alternative investments are mostly owned by those with high-net-worth and accreditation, or by institutional investors owing to the fact that these investments are quite complex with limited regulations.

"In investing, what is comfortable is rarely profitable."- Robert Arnott

Alternative investments have some important advantages. They help diversify both return and growth streams and help increase the income. They also have less interest risk as well as minimize drawdown risk. Alternative investments have begun to gain traction in the past couple of years due to its different approach for investors and also because long-term investors are grasping the importance of including alternative investments into the diversification of their portfolios. In fact, alternative investments act as a defense rather than an offense investment. They also give the investors a risk/return profile that is different from that of equities, bonds or cash.

Unfortunately, these advantages are weighed out by its limitations. The asset classes are less regulated, often offer limited transparency and are often difficult to measure and evaluate. This is because the transactions that are carried out are complex and unique. The lack of regulations leads to an increased risk of fraudulent activities. There is also a lack of means for publishing authentic performance data and advertising to other investors. This translates to low liquidity of the alternative investment assets.

Another major disadvantage is the high minimum investments and fee structures compared to mutual funds and exchange-traded funds (ETFs). Additionally, changing and evolving regulations to provide additional security for investors, has only increased the cost load on alternative asset managers, which makes the industry more incentivized to increase the assets under management, rather than focusing on enhancing investment returns. Because of this, the benefits and importance of alternative investments go unknown and unreachable to the common public who cannot afford these high expenses. Thus, there is a dire need for a solution which eliminates the limitations that exist in the current alternative investment schemes and helps it reach the common public at an affordable rate. This is exactly what DarcMatter aims to achieve by using blockchain technology.

What is DarcMatter

DMG is an innovative alternative investment, which is directly related to public funds. However, it has one important feature: the project is built on blocking technology and opens up complete transparency and security of the industry. Previously, it looked like this: there were a lot of scammers in the public fund, who blatantly deceived their clients. Now all this is not, because the DarcMatter platform creates openness and security during the execution of transactions.

At the moment, the platform has decided to improve its activities and bring it to a completely different level, having implemented the technology of blocking.

DarcMatter is the first decentralized project intended for the sphere of alternative investments. The project is already well integrated into this industry, and therefore its services are used by people from more than 24 different states. Given that the project is globally used, the team is trying to produce special solutions that use advanced technologies. Although the scope of alternative investments has been able to go a long way since the day of its formation, most of the tasks in this field are carried out at the expense of the "manual regime".

Consequently, the project needs intermediaries and service providers in order to comply with the security and transparency that investors need for cooperation with funds. The problems of the market today For a long time there is a huge number of negative attentions to the sphere of alternative investments. This industry includes many funds, and therefore alternative funds are the most important class of assets around the world. Alternative investments are everything that does not apply to ordinary cash, shares and bonds.

The main problems of the market are as follows :

There is no transparency. Alternative funds lack transparency. At the time of the issuance of alternative funds, assets were registered for the most sophisticated, for wealthy firms and investors ..

The Blockchain Solution

Blockchain technology provides security, transparency and affordability -- features which current alternative investment assets are lacking in. Thus, DarcMatter has created a blockchain-based decentralised platform which works on the crypto-token called DMC as the utility token, which incorporates the features of blockchain technology into alternative investment funding. Not only this, the blockchain implementation leads to the provision of additional capabilities like effortless cross-border investment, documentation tracking for multi-consensus and logging and additional asset classes being seamlessly distributed through the entire investor vertical. It is these features that sets DarcMatter apart from the blockchain investment ventures by its contemporaries.

DarcMatter has already received positive recognition and several accolades for its product. It has reached several countries across the globe and is ready to scale for more. DarcMatter has found the perfect application for blockchain technology, which properly complements the uses and features of the technology. At this rate, DarcMatter is destined to get only more and more successful and be the best in business.

How does the platform work?

- The unified fund manager creates a special profile that will be used on the platform.

- All transactions and contract terms are stored in a special register, where all information will be collected.

- The system will independently look for investors and offer them certain deals. This is beneficial for all parties at once.

- After that, the investor can accept or reject the offer to invest their own funds.

- Also, single databases are created and full access is established on the basis of a secure protocol.

Ico details

- Start Crowdsale on June 15 and will last until June 30, 2018.

- The name of the platform is DMC. The token type is XEM.

- The cost of the token is - 1 DMC = $ 0.2.

- The platform on which the token works is NEM.

- Softcap - $ 5,000,000. Hardcap - $ 35,000,000.

- You can pay a token - BTC, ETH, XEM.

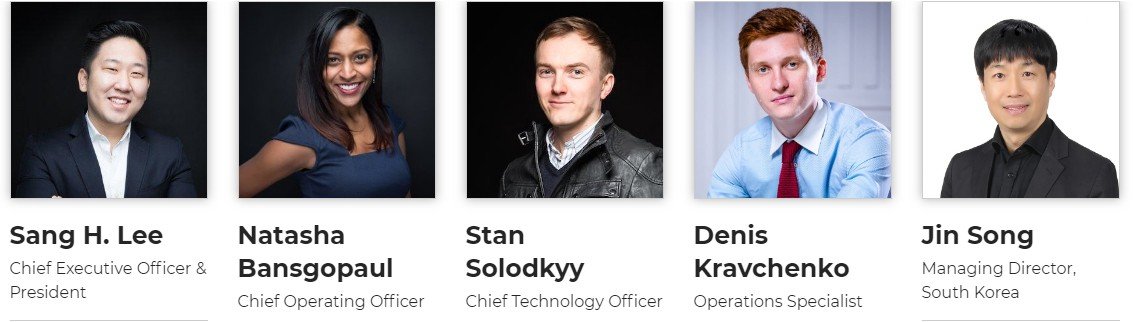

Team

Partners

Project Conclusion

DARCMATTER solves the global problem. It is able to expand the possibilities for investing private investors and ensure the flow of capital into alternative funds.This will have a beneficial effect on the investment environment in the world as a whole. The project really solves a number of problems of alternative funds on a global scale, which is burning with its prospects in development ..

For More information follows;

Keep Tabs On Me Daily articles about cryptocurrency and blockchain based projects.

No comments:

Post a Comment